This is issued by the financial house you’re saving with, or shown as a deduction on your IRP5 from your employer (if they’re paying it on your behalf as a part of your overall remuneration). In order to claim this tax break, you’ll need to have proof of your retirement contributions in a certificate called a RAF Contribution Certificate. However, a Retirement Annuity (RA) is a retirement fund for individuals who are self-employed, or whose employer doesn’t offer a RA benefit as part of their remuneration package. Your IRP5 is sufficient proof for tax purposes and you don’t need to do anything else on your tax return to claim these deductions. Saving towards a Pension or Provident Fund is always done via your employer and therefore your contributions will reflect as a deduction on your IRP5. How do I claim this expense on my tax return? The long-term benefits of having private retirement funds are certainly going to see you being comfortable in those golden years, which is what we’re aiming for. It’s important that you’re not just saving for retirement to enjoy a tax saving benefit (i.e you should be putting more away than what you’re getting back in tax). This means that Joe’s annual income, for tax purposes, drops to R 199 500, saving him R 5 290 in tax for the year (which is the difference in tax due between R 228 000 and R 199 500).

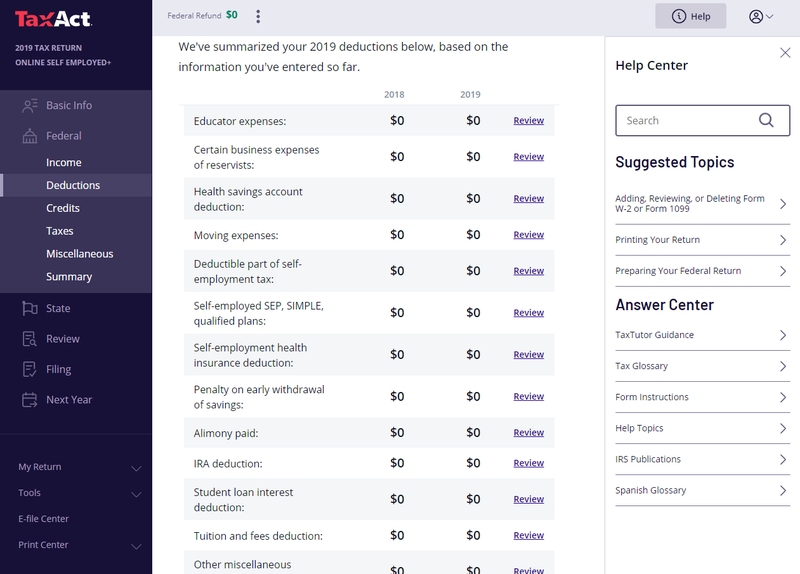

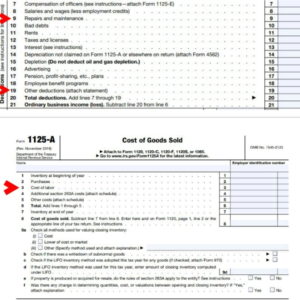

#Tax act contractor expenses full#

He can deduct the full amount as its below 27.5% of his annual income (which would be R 62 700). The tax deduction is capped at R 350 000 per annum.įOR EXAMPLE: If Joe earns R 228 000 during the 2023 tax year, and saves R 2 375 per month in a retirement annuity fund (well done Joe!) it means he’s saved R 28 500 for the year. If you contribute to a pension, provident or retirement annuity fund, you’ll qualify for a tax deduction up to 27.5% of your annual income, limited to no more than the actual contributions you made. If you don’t pay tax, then you can’t claim these things back. Now that you know whether or not you have to pay tax, lets delve into the different things you can claim back for, if you fall into the bracket of people that have to pay tax. Take a look at the table below to see how much you can earn, before having to pay tax. Now that we know whether or not you fall into the category of Employee, let’s talk about how much moola you can earn before having to pay taxes!

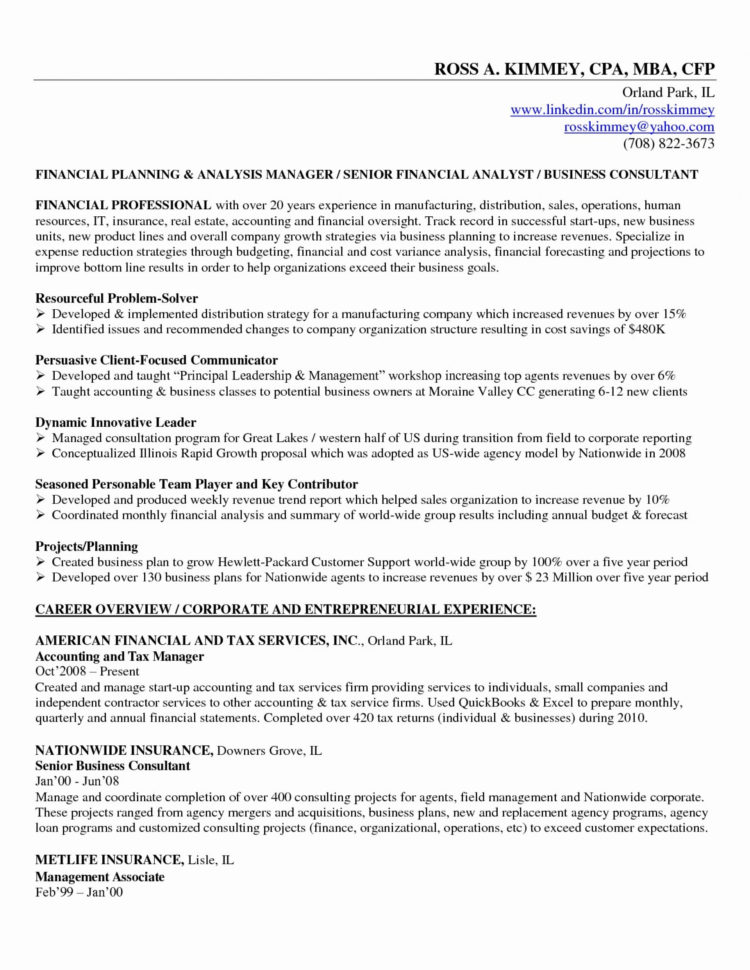

If you’re self-employed and running your own business, or working as a “freelancer” or independent contractor, then your earnings are not classified as remuneration and therefore you are not an employee. Remuneration will include: salary, fee, bonus, wage, gratuity, pension, leave encashment, emolument, voluntary award, commission, annuity, stipend, overtime, superannuation allowance, retirement allowance, lump sum benefit payment, director's remuneration, etc.

fringe benefit) and whether or not for services rendered. Remuneration is any amount of income which is paid/payable to any person whether in cash or other ways (e.g. GREAT! So, what is the meaning of remuneration, for tax purposes?

Generally, they will work full time for one employer and have no other jobs. This may seem like a simple concept, but let’s make sure that we’re all on the same page as to who and what an employee is! An employee is any person (other than a company) who is paid by an employer for work performed.

0 kommentar(er)

0 kommentar(er)